Monthly Market Overview - January 2026

Voluntary Biodiversity Market activity, trends, news, and developments.

2026 starts on a slow but steady note for the Voluntary Biodiversity Market (VBM) with more than $56k in recorded sales for January, doubling the previous month’s total, led by Seatrees, Niue Ocean Wide Trust, and Ekos. The market headlines showcase a continued trend to standardize the tools, the assessments, and the outputs of the market’s projects.

This article is the first edition of the Monthly Market Overview based on our intelligence platform Bloom. It covers market activity, global trends, news, and developments from VBM across:

Transactions

Projects

Organizations

Headlines

Reports

Events

For more in-depth VBM insights and access to Bloom data, sign up for free on the platform.

Market

Context

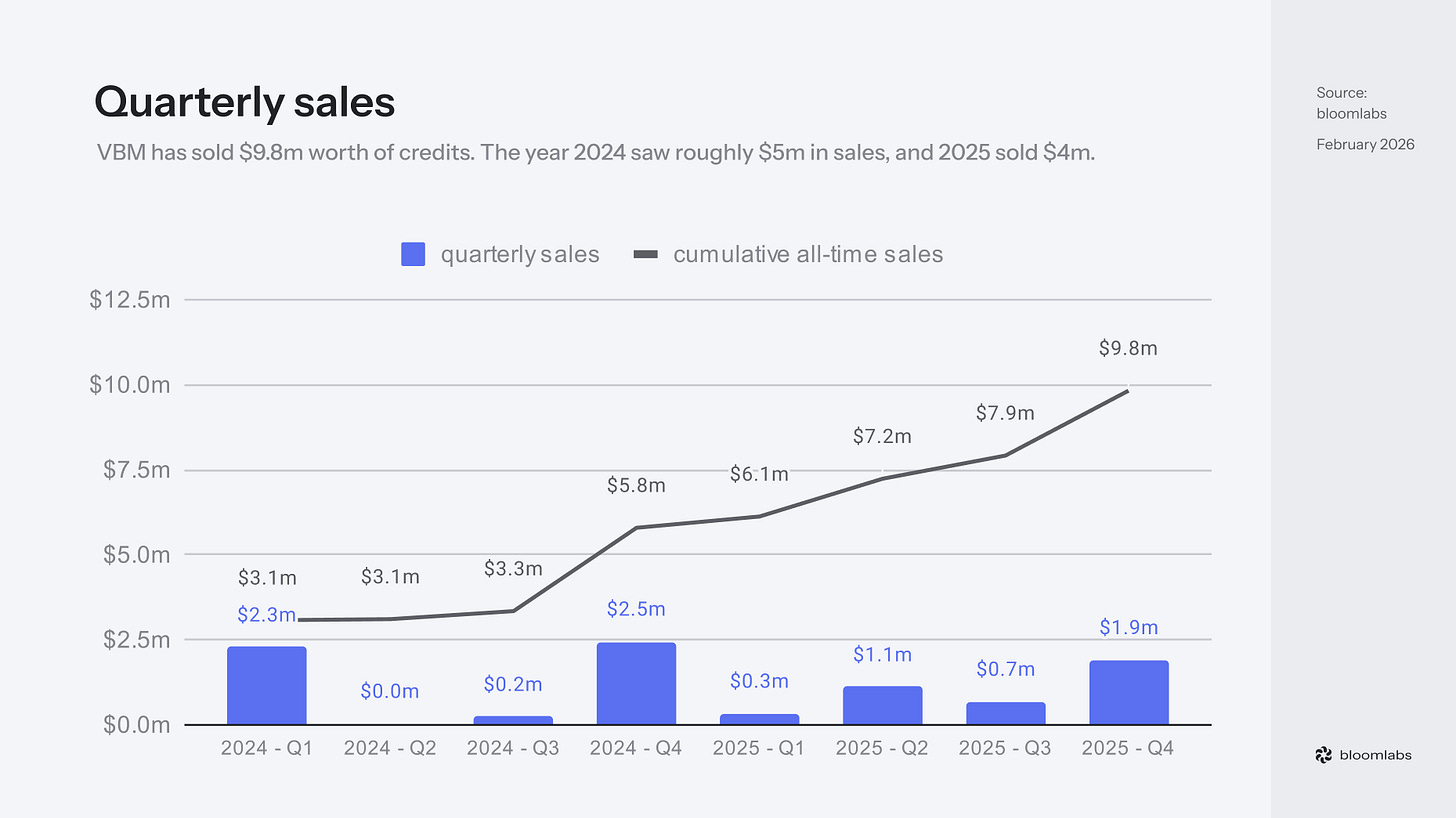

VBM has sold $9.8m worth of credits. The year 2024 saw roughly $5m in sales, while 2025 saw $4m transacted, but with a constant progression from $0.3m in Q1 to $1.9m in Q4. However, two large aggregated records that consist of multiple transactions are to be noted: a $2.2m aggregate for the Niue Moana Mahu project in Q1 2024 and a $1.1m aggregate for Wilderlands’ projects in Q4 2025. Hence, quarterly trends should be treated with caution until more granular information can be collected.

January 2026

Disclaimer: This section only accounts for single transactions. Aggregates are excluded since they would highly impact the month-level granularity needed for the analysis.

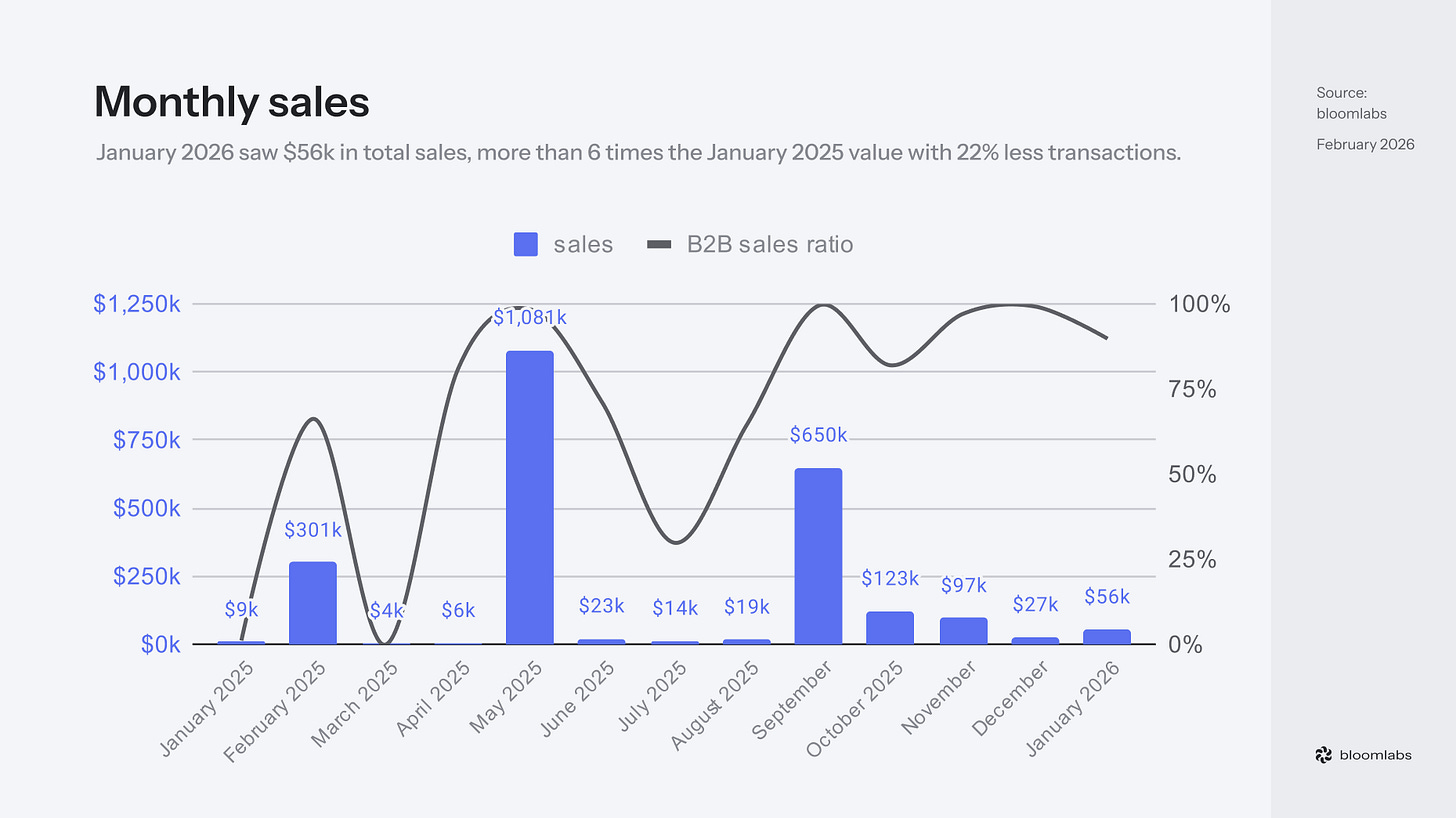

January 2026 saw $56k in total sales, more than 6 times the past year’s value, with 22% less unique transactions.

Sales were 90% B2B and confirm a growing trend, as this type of purchase only represented on average 53% for the first half of 2025, and 79% for the second. The growing B2B engagement rate is a positive sign of corporate interest, but it has yet to show up in tangible dollars spent, as the average transaction value ($900 for January) has been on the downside since September 2025. It is, however, still 8 times higher than last year.

This month’s average weighted $/ha/year reaches around $2,980 due to Marereni sales. It confirms an upward trend in this indicator, reaching $1,200 for H1 2025 and $1,500 for H2 2025 on average, although a high month-on-month variance is notable. This indicator is, by design, highly impacted by projects selling large unit quantities, like Marereni.

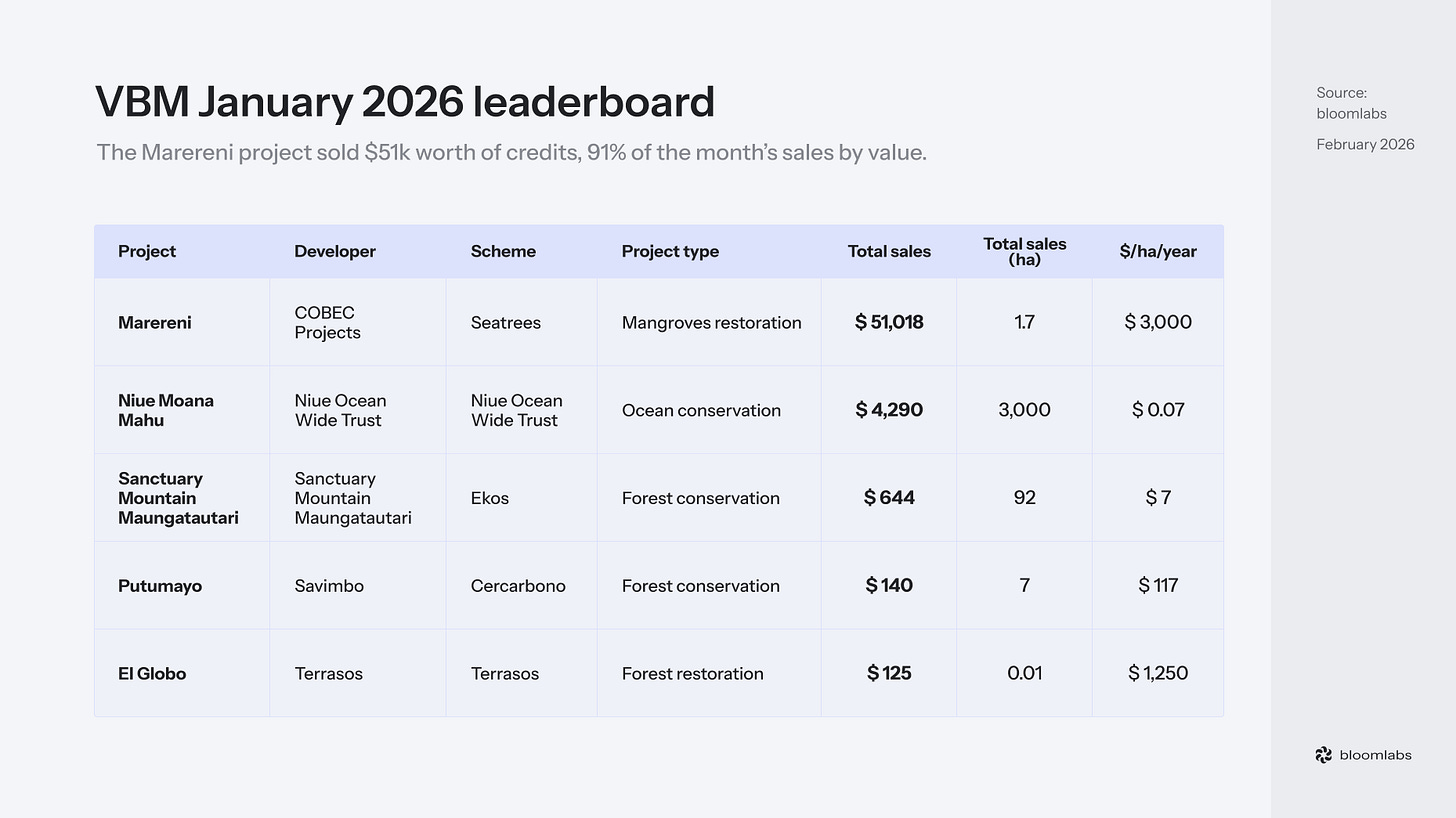

The Marereni project sold $51k worth of credits, representing 91% of the month’s sales by value, and covering 1.7 hectares of land. The Niue Moana Mahu sold $4k worth of credits, 8% of the month’s sales by value, or 3,000 hectares of land. The Sanctuary Mountain Maungatautari sold $644 worth of credits at 1% of the month’s sales by value (92 hectares). The month’s biggest transaction is B2B and reaches $27k on the Marereni project, although more detailed information has not been obtained yet. The Marereni project, developed by Seatrees and COBEC Projects in Kenya, restores mangroves using the Seatrees+ blocks for funding. The project chose a volume strategy, with cheap ($3) and small (1m²) units adapted to mangrove projects, making them easier to sell, especially to B2C buyers.

Projects

Chishui

The Asian Development Bank (ADB) and the Chinese government are launching a $150m-funded nature credit pilot in the Chishui River Basin. The project will be built “in conjunction with an eco-compensation fund to demonstrate the case of investing in nature,” explained Xueliang Cai, Senior Water Resources Specialist at ADB. From a VBM perspective, it is the most well-funded project and thus has the potential to help scale the market alongside China’s place in it. The country, armed with a particularly efficient structure of command, a megadiverse fauna and flora, a highly capable financial system, and more than 9 billion hectares of land, has all the cards to become a global VBM leader in the coming years.

Finsilva

The to-be-launched Finsilva Pilot in Pielavesi will be the first known VBM Finnish project. The S Group, one of Finland’s largest retailers, will purchase “nature value hectares” produced by the landowner Finsilva through the restoration of 12 hectares of degraded peatland. This project is coordinated by Tapio Palvelut and LocalTapiola, with verification provided by the Finnish Supervisory Agency, and will follow a contribution-based model excluding compensation or offsetting. We have reached out to the developers to learn more about the project.

Formentera

The Formentera project from Nature&People Foundation officially started its pilot phase to plant 2,500 trees. Using the Urban Biodiversity Standard (UBS) scheme, it aims to issue more than 1 million credits over 20 years, with each credit representing 100m² of maintained green coverage. The project’s core objective is to cool the island with a temperature reduction of 1°C to 3°C in targeted areas. The Urban Biodiversity Standard and over 50 other voluntary biodiversity credit schemes are available on Bloom.

Headlines

The Landbanking Group open-sourced framework

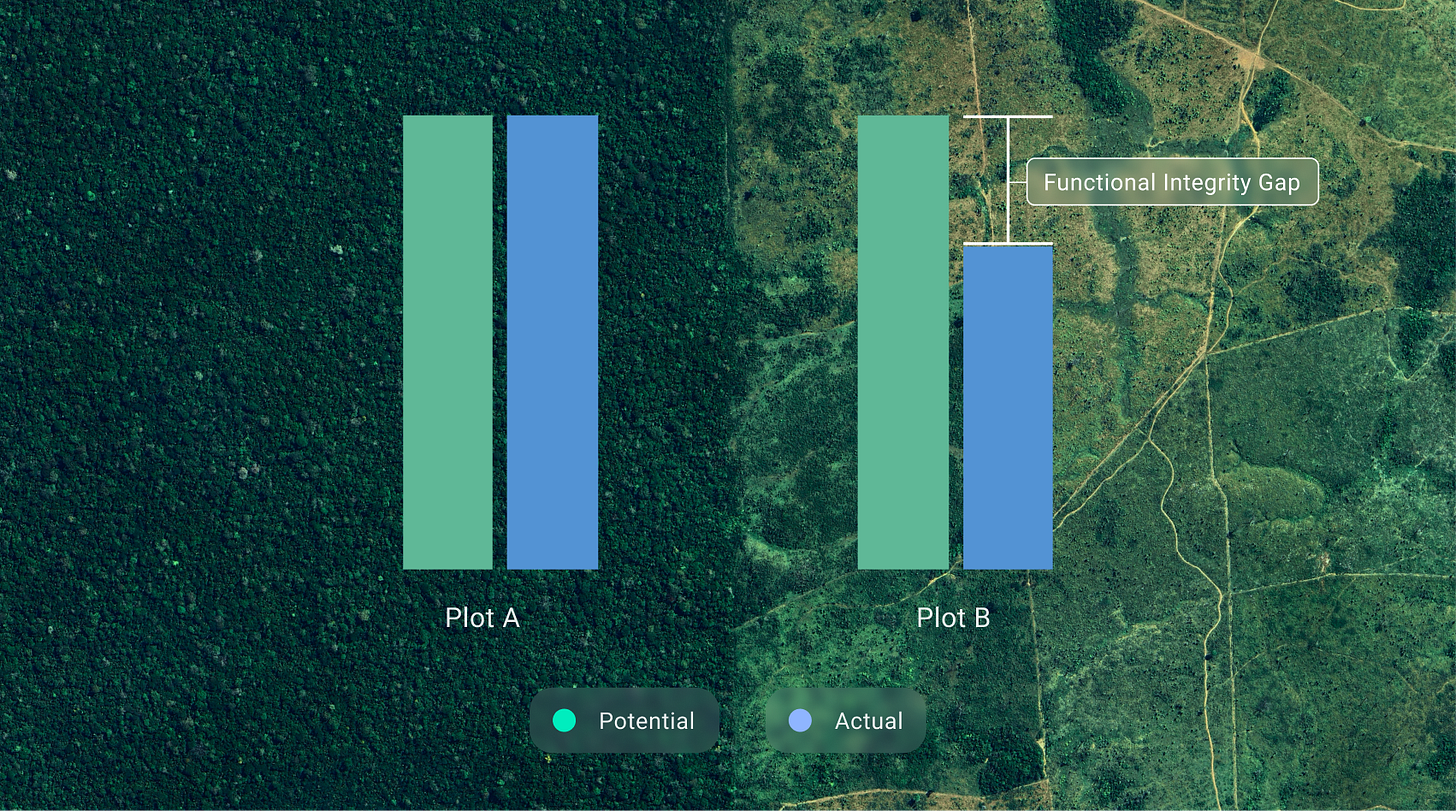

The Landbanking Group officially open-sourced their Ecosystem Integrity Index (EII) codebase and global dataset to assess ecosystem health at a 300-meter resolution. The EII generates a standardized score from 0 (degraded) to 1 (intact) by synthesizing three pillars of ecological health: Functional Integrity, Structural Integrity, and Compositional Integrity. The goal is to provide a trustworthy proxy, a “good-enough” measurement tool, that can be used everywhere, by everyone.

The reliability and relevance of the EII will have to be assessed by the scientific community, but from a market perspective, it is a potential step forward to standardization and scale. It can provide suppliers and buyers with a shared tool to measure a baseline and the change that happened against it, and it makes projects comparable between one another with the same data types and formats. And, most importantly, the same base unit which can be used well beyond biodiversity credits.

Superorganism closes $25.9 Million fund for biodiversity startups

Superorganism, a venture firm dedicated to biodiversity, has closed its $25.9 million biodiversity-only debut fund. The fund is structured to provide seed and pre-seed capital to early-stage startups that address nature loss through technology that slows or reverses extinction.

The successfully closed fund creates a precedent in the venture space, legitimizing pure-play biodiversity funds instead of only high-level climate/impact players. We believe it is the first of many such funds.

BCA tests its High-Level Principles on the ground

The Biodiversity Credit Alliance (BCA) has initiated a testing phase of its High-Level Principles (HLPs) Assessment Matrix v1.0 to evaluate the integrity of methodologies. As part of this pilot, WWF Tanzania assessed its Wildlife Credits, and Seatrees used the matrix to evaluate its Crediting Protocol for Marine Restoration. This learning phase is intended to inform a more robust Assessment Framework currently being co-developed with partners, including UNDP and Accounting for Nature.

Practical tools for scheme and project developers to objectively measure their alignment with high-integrity benchmarks is a crucial step forward that helps standardize the fragmented voluntary biodiversity market and increases buyer trust. BCA continues to respond to the desperate need for VBM to consolidate more.

EU Commission to support nature credits with bioeconomy strategy

European Commissioner Roswall addressed the European Parliament, outlining a bioeconomy strategy that explicitly champions nature credits and the formation of a “Bio-Based Europe Alliance” to drive €10 billion in bio-based solutions purchasing by 2030, alongside a EU buyers club for carbon credits.

The Commission’s commitment to creating an environment to “stimulate demand for market mechanisms” is exactly what VBM needs to transition from a niche philanthropic effort to a standardized asset class.

UNEP State of Finance for Nature 2026 report

The report reveals a disparity in global capital allocation with nature-negative financial flows reaching $7.3t in 2023 and outpacing investments in nature-based solutions (NbS) by a factor of 30 to 1. While NbS received $220b globally, private finance accounted for only $23 billion of that total. The last version of the report, published in 2023, already identified a $7t vs. $200b funding gap.

The report identifies high-impact sectors, specifically utilities, industrials, energy, and materials, making them ideal targets for future VBM demand as they face increasing pressure from the market to transition to nature-positive business models.

Peru progresses on national framework for biodiversity credits

The Peruvian Ministry of the Environment (MINAM) has officially approved the “Guidelines for the design and operation of biodiversity credit projects” through a Ministerial Resolution. This framework will guide the technical orientation required to implement biodiversity credits in the country.

These guidelines will provide the assurance layer that investors and local communities need to participate, something that VBM currently lacks. The Peruvian Sierra del Divisor project, developed by Fronterra, and one of the largest VBM projects in the world, might be the perfect testing ground.

Trinidad and Tobago to launch biodiversity credit framework

The Institute of Marine Affairs (IMA) of Trinidad and Tobago, supported by funding from the British High Commission, has started the development of a national certification framework for coastal and marine biodiversity credits. It will establish a structured, investment-ready environment with an initial focus on sandy beach and dune habitats, with future integration planned for coral reefs and mangroves.

Beyond creating the first-ever regulatory national biodiversity credit scheme designed directly for coastal and marine ecosystems, Trinidad and Tobago’s push can boost the local and regional voluntary scene. The UK’s Biodiversity Net Gain is one illustration of this effect.

Suggested reads

Biodiversity and carbon credits in practice

“Biodiversity and carbon are joined at every level: ecological, financial and political. That inevitably links the voluntary biodiversity market (VBM) and the voluntary carbon market (VCM) together. And although the post Global Biodiversity Framework biodiversity credit excitement faded, the biodiversity <> carbon topic is just as relevant. As reality sets in and market develops, we are moving from theory to practical implementation. It is time to go beyond a heavily simplified biodiversity credits vs carbon credits analysis and attempt to better define their overlap between these markets.”

Five rules for scientifically credible nature markets

“Here we synthesize international research from the history of nature markets and summarize five rules that are necessary precursors for achieving their environmental aims. We propose a checklist for investors, policymakers and civil society to assess whether nature markets are likely to be delivering scientifically credible outcomes. We score the world’s largest nature markets against these rules and show that all face integrity risks. Lastly, we outline critical evidence-based actions that can be taken to push nature markets towards greater integrity.”

This paper is an essential contribution that provides a rigorous, science-based and evidence-based stress test for nature markets. Everyone praises positive outcomes, but this kind of analysis is what the industry needs to objectively assess them.

Mercer’s Nature Market Research

“To provide investors and wider market participants with an analysis of current market signals and investment opportunities, we undertook a Nature Market Research study between January 2024 and July 2025. Gathering responses from 70 managers covering 89 private market nature strategies (closed and fundraising), this paper draws on the research findings.”

This report provides extensive insights into investment funds’ approach to financing nature. Which land types, which activity types, and which credit types are being targeted by the organizations that will likely shape the future of demand-side VBM.

Upcoming from us

We are working with key market participants to build the conditions for VBM to scale by providing extensive market intelligence. Our current focus is on understanding the demand side and the levers to unlock it.

Market Study on Scaling Biodiversity Markets

This study, commissioned by the European Investment Bank (EIB) and conducted together with CDC Biodiversité and the Mission économie de la biodiversité initiative, with the participation of bloomlabs, explores the demand for voluntary biodiversity certificates among French corporates and financial stakeholders, with the aim of informing EU-wide market design and policy recommendations.

The Nature of Demand

This white paper is a strategic collaboration between IAPB, the World Economic Forum (WEF), and bloomlabs to publish a data-backed segmentation of buyer archetypes based on actual biodiversity credit purchases made. The aim is to unpack why companies buy biodiversity credits and what else could be done to position VBM as an attractive option to make nature-positive contributions. If you have purchased or are thinking of purchasing biodiversity credits, please reach out to hello@bloomlabs.earth. We would love to hear from you.

2026 Nature Markets Survey

Jointly produced with Pollination Foundation, this survey will collect signals on market size, pricing, credit design, demand drivers, and rights-based participation to support a market snapshot covering the biennium 2024-2025. If you are a project developer or credit scheme administrator and have still not heard from either Pollination Foundation or us, please reach out to hello@bloomlabs.earth as well. We would very much appreciate hearing your experience.

Biodiversity Credits in European Wetlands

We are part of the EU LIFE project funded by the European Commission, “LIFE Biodiv CrEW: Testing Biodiversity Credits in European Wetlands”. There we are exploring how biodiversity credits can be developed and transacted in European peatlands and wetlands. Our consortium members are engaging with companies that want to learn, test, and help shape this emerging market, including options for early participation. To learn more or get involved, feel free to contact Marc Maleika from Sylva at marc@sylva.earth.

Upcoming events

The Business of Conservation Conference 2026

The African Leadership University with International Institute for Environment and Development (IIED) will create a physical space in Nairobi, Kenya where potential biodiversity credit buyers and offtakers can have in-depth discussions with the leading African biodiversity credit suppliers. The market definitely needs more of these initiatives. The event is expected to draw 450 participants. If you’re interested in sponsoring the event or have any other questions, reach out to Paul Steele.

Thanks Martin & Simas - fantastically useful review - as ever.