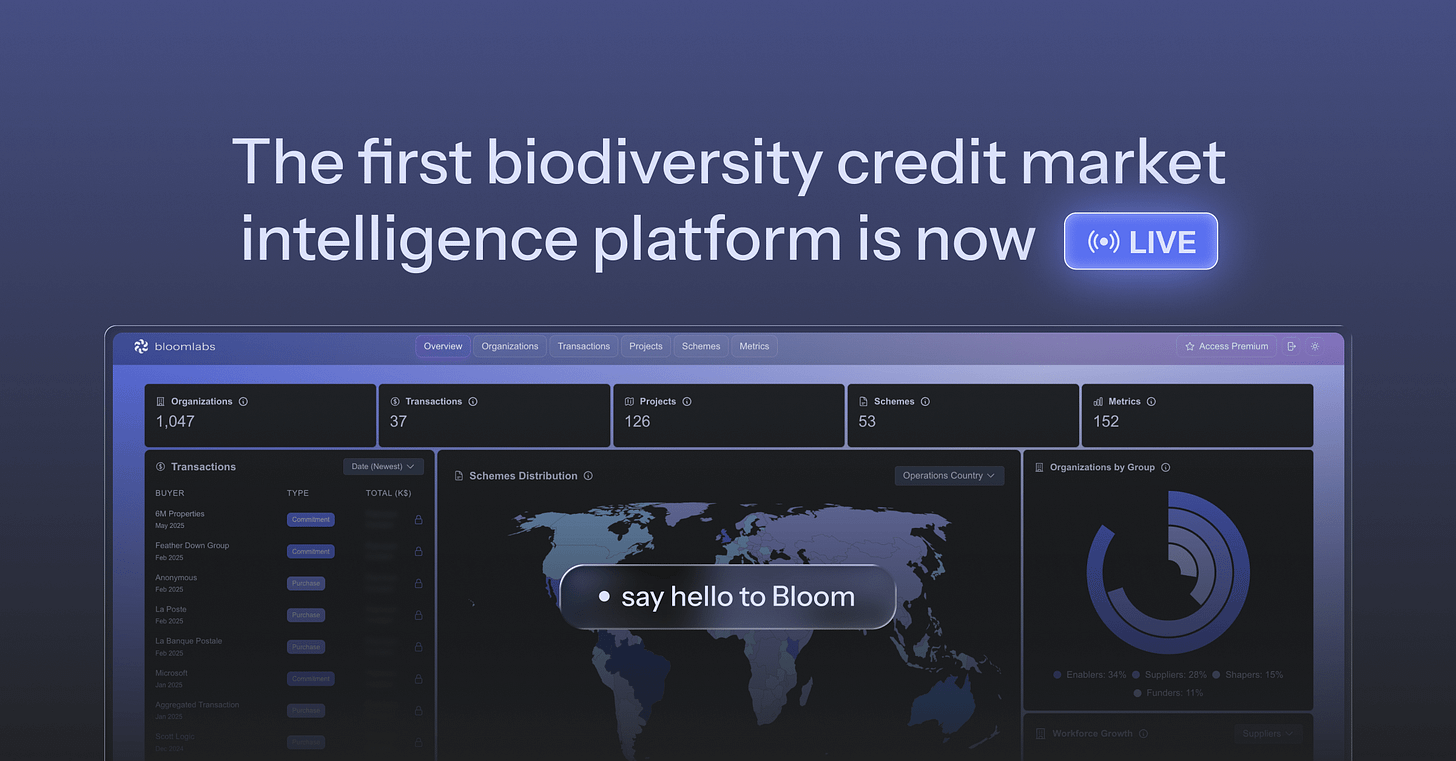

Launching Bloom 🌱

Say hello to the world's first market intelligence platform for biodiversity credits

Hi folks 👋

The day I was alluding to a couple of months ago has come. I’m proud to announce Bloom - the world’s first market intelligence platform for biodiversity credits.

The idea I had in mind for years has finally become a reality, with the help of Martin and Tassilo - the best partners I could have ever asked for.

Bloom 🌸

The platform is built on the largest database of structured voluntary biodiversity credit data. In particular, it’s composed of 5 datasets:

Schemes

The first dataset I’ve started 2+ years ago. It became the go-to place to review the voluntary biodiversity credit scheme landscape for, I believe, most of the market participants. Recently, it was even cited in the European Commission’s Roadmap to Nature Credits.

Projects

Our brand new dataset with more than 120 biodiversity credit projects globally, across every project stage. It was the missing piece in our arsenal & we’re very excited to finally present it to you!

Transactions

The most extensive list of voluntary biodiversity credit transactions.

Organizations

1,000+ verified market participants across supply, demand and everything in between.

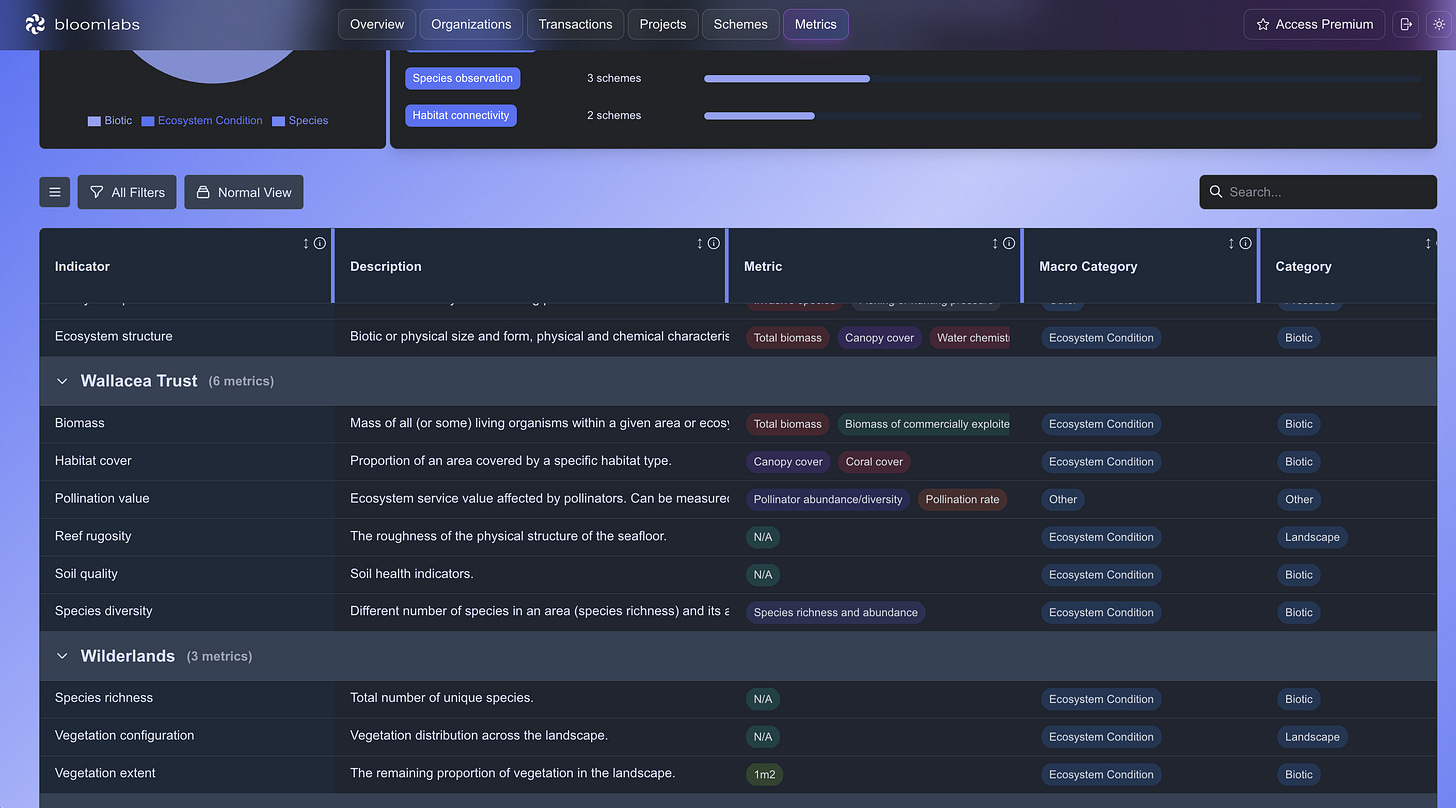

Metrics

A non-exhaustive list of biodiversity indicators and metrics used to calculate biodiversity credits. Developed in partnership with BioInt, led by Joshua Berger.

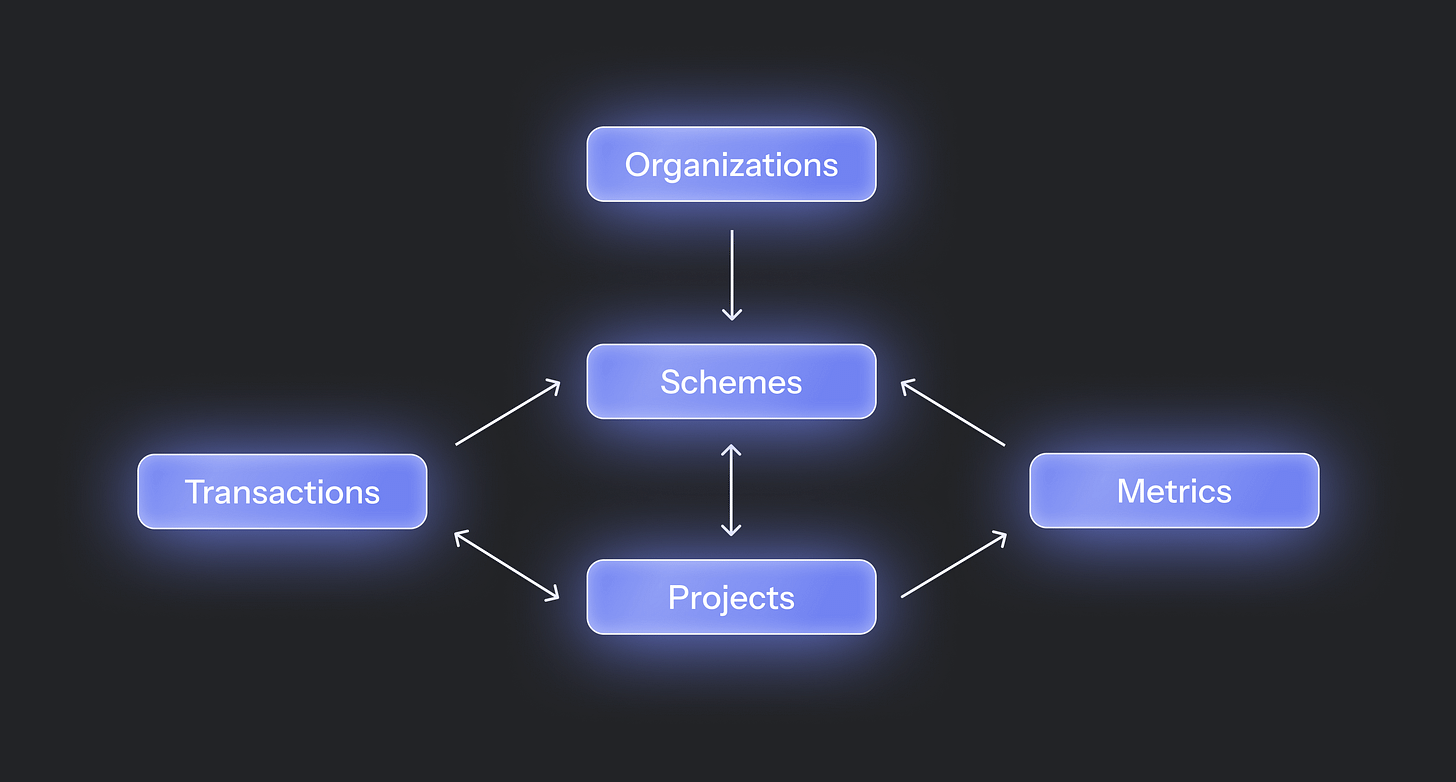

Each dataset is valuable in its own right. The real difference maker is when you put them together though.

Example

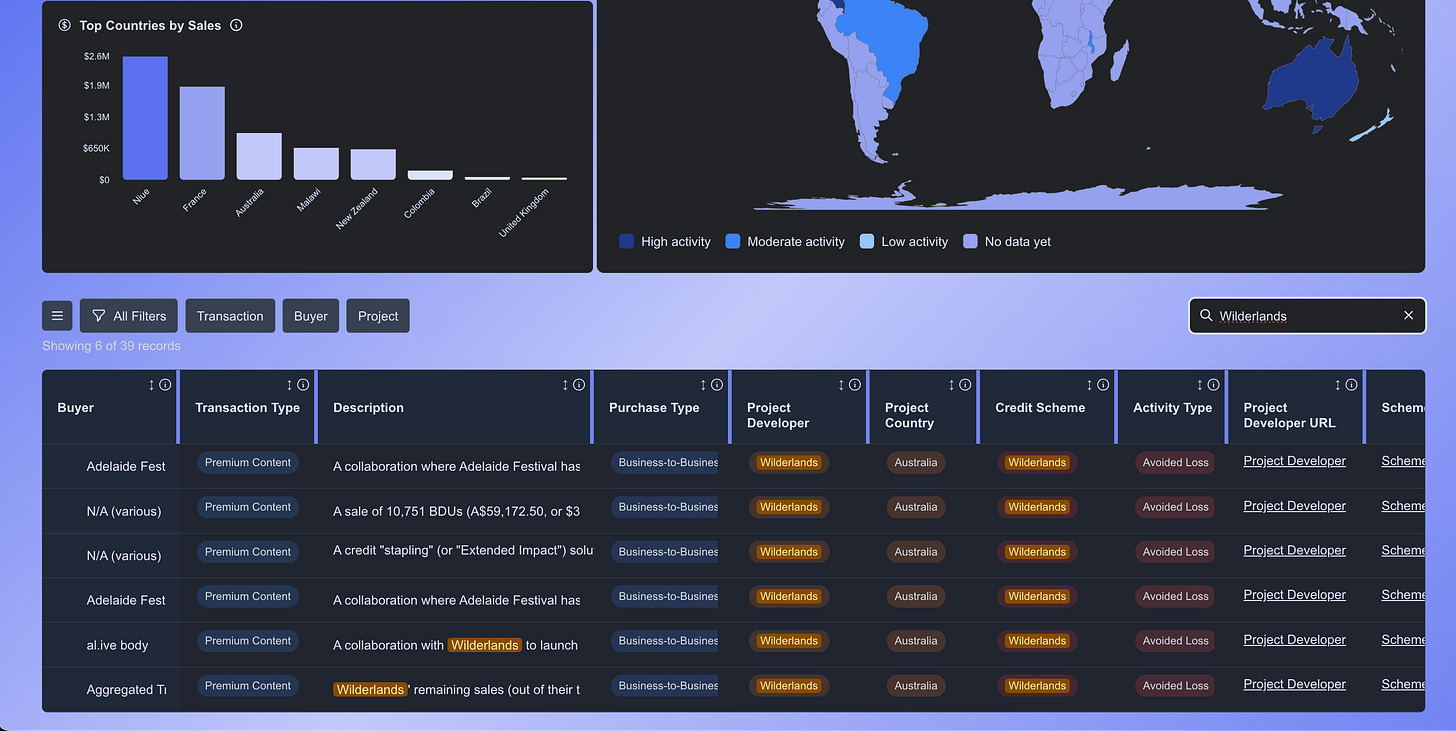

Imagine you go to the Transactions section and notice that Wilderlands has sold almost $1m worth of credits.

You then scroll down to the Transactions dataset and, after searching for “Wilderlands“, find 6 transactions. You can see each transaction, whether it’s standalone or aggregated, who purchased credits, how much and, whenever possible, why.

We can do more. You might want to check out their methodology, summarized via 50+ structured data points. There you might notice that they’re the leading Australian practice-based biodiversity credit project developer with their own methodology and, according to it, each credit is 1m2, permanently preserved.

You can dive deeper and analyze some of the metrics they use to measure their projects.

Interconnected whole

Now, such information might be common in most other markets. We’re meeting the biodiversity credit market where it is though - early, fragmented, “pre-certification”.

Who is the platform for?

Market intelligence platforms have a blessing and a curse of being at least a little useful to almost everyone in the market.

More specifically though, we have seen particular interest from these groups:

Credit schemes and project developers

The supply side. Credit schemes carefully follow market developments and want to know what other schemes do. Project developers often want help in selecting a credit scheme and also closely follow latest market developments.

Consultants

The best consultants make sure their analysis is backed by extensive and accurate data. Bloom acts as the source for most of such needs. We’ve been using it for all of our recent consulting assignments and can attest that it works :)

Investors

In our experience, investors track market trends and usually spend a lot of time on project due diligence. In Bloom, they can access 350+ relevant project developers that can be sliced and diced according to geography, project activity, size and many more variables.

We also see interest from policy makers, NGOs, research institutions and buyers.

Rule of thumb: if you’re reading this newsletter, chances are Bloom is meant for you :)

Pricing

I started work in this space with an open source ethos. bloomlabs will maintain it. That’s why we’ll keep the free version as valuable as possible with ~75% of all data being freely accessible.

Organizations that want additional key data (e.g. scheme analysis or pricing and project-level insights) or plan to directly use our data commercially can choose a paid plan that works best for them.

What’s next?

1. Processing your feedback

We’ll listen to reality (i.e. you) before continuing with our grand plans.

2. Starting a regular newsletter

We’ll soon start publishing the newsletter every 2 weeks, powered by this data engine of ours.

3. Improving the platform

We can make the data more interconnected. We can surface real-time market insights. We can further automate our data collection, aggregation and processing process. And so much more..

As I shared earlier, voluntary biodiversity market is just the start. We’re on to something with the tech we’re building for generating real-time AI insights based on exclusive structured market data.

Take a look!

If you don’t see yourself or your market activity (especially transactions!) in the platform, submit it via our data submission hub!

If you want to access the premium version of the platform, reach out to us or ping me personally at simas@bloomlabs.earth

Thank you all once again for being part of this journey to scale nature finance.